Commercial Tobacco and Nicotine Taxes

Preventing new cigarette smoking and decreasing the use of other commercial tobacco and nicotine products are key goals of the SUTPP and the CDC.

According to the CDC, increasing tobacco product prices is an effective way to prevent youth from starting to smoke (CDC, 2014b). It also encourages adults to quit smoking (CDC, 2015).

Taxes are one way that state governments can influence tobacco prices. Nationally, every 10% increase in cigarette prices decreases cigarette use by 3–5%. Raising cigarette prices prevents youth and people with lower incomes from smoking and reduces the average number of cigarettes smoked (U.S. Department of Health and Human Services [USDHHS], 2014).

In one study of adults aged 50 years and older, a $1 increase in the price of cigarettes was associated with a 6% higher quit rate (Stevens et al., 2017). Increasing cigarette taxes could encourage quitting among older adults and could decrease the risk of smoking-related diseases.

Commercial Tobacco and Nicotine Tax Rates

Cigarettes

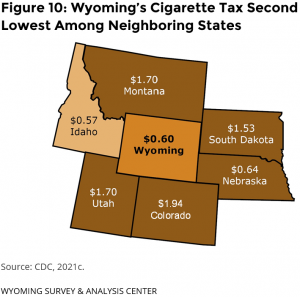

At the time of data collection, Wyoming’s cigarette excise tax was $0.60 per pack, the second lowest in the region (Figure 10). Wyoming ranks 44th out of 51 states (including DC) on cigarette taxes (CDC, 2021c). Wyoming’s cigarette excise tax has not changed since 2003.

At the time of data collection, Wyoming’s cigarette excise tax was $0.60 per pack, the second lowest in the region (Figure 10). Wyoming ranks 44th out of 51 states (including DC) on cigarette taxes (CDC, 2021c). Wyoming’s cigarette excise tax has not changed since 2003.

Smokeless Tobacco

At the time of data collection, Wyoming’s smokeless tobacco (chewing tobacco, snuff, dip, or snus) tax had a minimum tax of $0.60 per ounce, with an additional $0.60 per ounce for packaging larger than one ounce.

Electronic Nicotine Delivery System

Since July 2020 and through the time of data collection, Wyoming has had a default ENDS tax at the rate of 15% of the wholesale purchase price. If the tax is not paid by the wholesaler, consumers pay 7.5% of the retail purchase price (2021 Wyoming Statute 39-18-104[g] https://wyoleg.gov/NXT/gateway.dll?f=templates&fn=default.htm).

Support for Evidence-Based Policy Has Declined

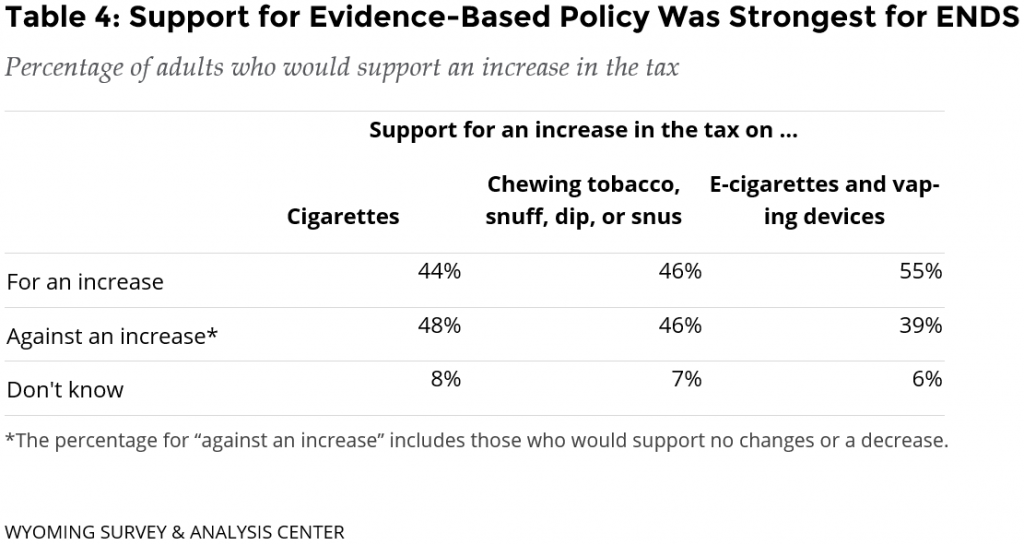

In the 2019 ATS, over half of Wyoming adults supported increasing the taxes on cigarettes (52%) and smokeless tobacco (54%; WYSAC, 2022). In 2021, support for increasing cigarette and smokeless tobacco tax had significantly decreased to just under half—44% and 46% respectively.

Support for increases in taxes on ENDS was stronger than for other taxes on tobacco or nicotine products (Table 4).

- More than half (55%) of Wyoming adults would support an increase in the ENDS tax,

- Less than half (44%) of Wyoming adults would support a cigarette tax increase, and

- Less than half (46%) of Wyoming adults would support a tax increase on chewing tobacco, snuff, dip, or snus.

Cost of Smoking

Smoking is the leading preventable cause of illness and death in the United States. In 2018, the costs of smoking-related illness totaled more than $600 billion. This includes more than $240 billion for direct medical care and more than $372 billion in lost productivity (CDC, 2022b). In 2009, Wyoming’s tobacco-related healthcare costs were $258 million (CDC, 2021a).

Commercial tobacco/nicotine prevention programs have been shown to reduce smoking rates and smoking-related costs. A study of Washington State’s tobacco/nicotine control program showed that for every $1 spent on the program between 2000 and 2009, $5 was saved in tobacco-related hospitalization costs (Dilley et al., 2012).

Conclusions

Wyoming adults’ support for increasing taxes on commercial tobacco/nicotine has decreased. In 2021, support for increasing cigarette and smokeless tobacco tax significantly decreased compared to 2019. Throughout the ATS 2021 data, there seems to be a decrease in support for government interventions that would benefit public health, including tax increases and smokefree indoor air policies and laws.

Between ATS 2019 and ATS 2021, there was a decline in support for public health policies as it related to the COVID pandemic (WYSAC, 2020). It is possible that this decrease has spilled over to other public health interventions.

Wyoming’s cigarette excise tax has remained at $0.60 per pack since 2003. Higher commercial tobacco taxes are an evidence-based way to keep youth from starting to smoke (CDC, 2014b). Increasing commercial tobacco and nicotine product pricing through taxation, minimum price laws, or other means is an evidence-based strategy for encouraging people to quit using commercial tobacco products (CDC, 2015). Wyoming could benefit from raising its tobacco or nicotine taxes.