Goal Area 3: Promoting Cessation

The TPCP and the CDC share the goal of reducing the health burdens of tobacco use by promoting and supporting quitting among adults and young people.

In this section, we explore smoker’s cessation efforts, including their desire to quit and quit attempts. We look at respondents’ awareness of quitlines, use of cessation aids, and barriers to quitting. The Wyoming Quit Tobacco (WQT) program is designed to assist with common barriers to quitting. This section also covers smokers’ visits to healthcare providers, respondents’ support of tobacco tax increases, and conclusions and recommendations based on the data and best practices in cessation efforts.

Smokers’ Cessation Efforts

Smokers’ Desire to Quit and Quit Attempts

Most smokers (68%) wanted to quit smoking cigarettes. Some (28%) said they did not want to quit. Few (4%) were unsure if they wanted to quit smoking.

Most smokers (68%) wanted to quit smoking cigarettes. Some (28%) said they did not want to quit. Few (4%) were unsure if they wanted to quit smoking.

At some point in their lives, about four out of five current smokers (81%) had stopped smoking for at least one day because they were trying to quit for good.

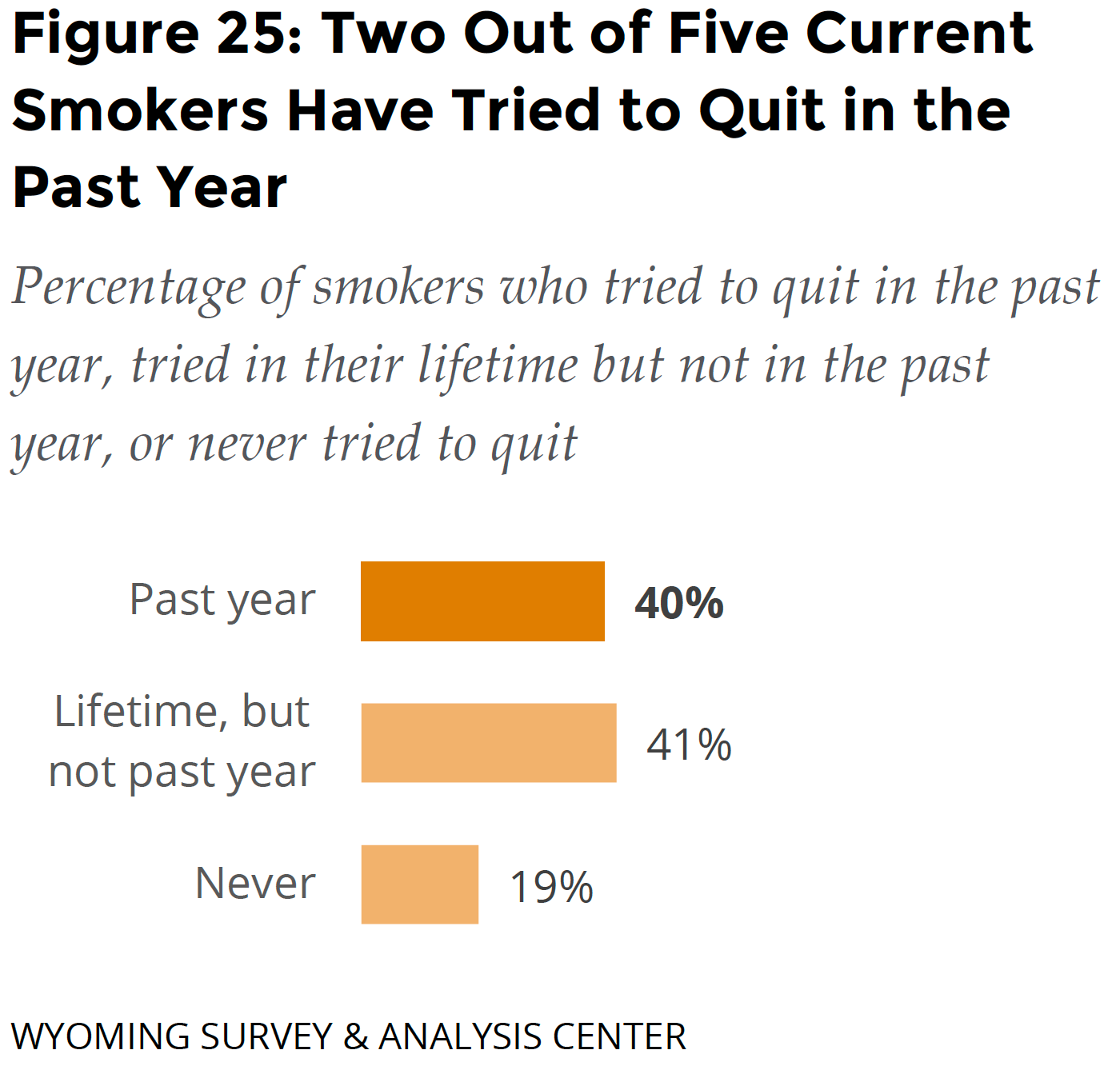

Two out of five (40%) current smokers have tried to quit smoking at least once in the past year because they were trying to quit for good (Figure 25).

Two out of five (40%) current smokers have tried to quit smoking at least once in the past year because they were trying to quit for good (Figure 25).

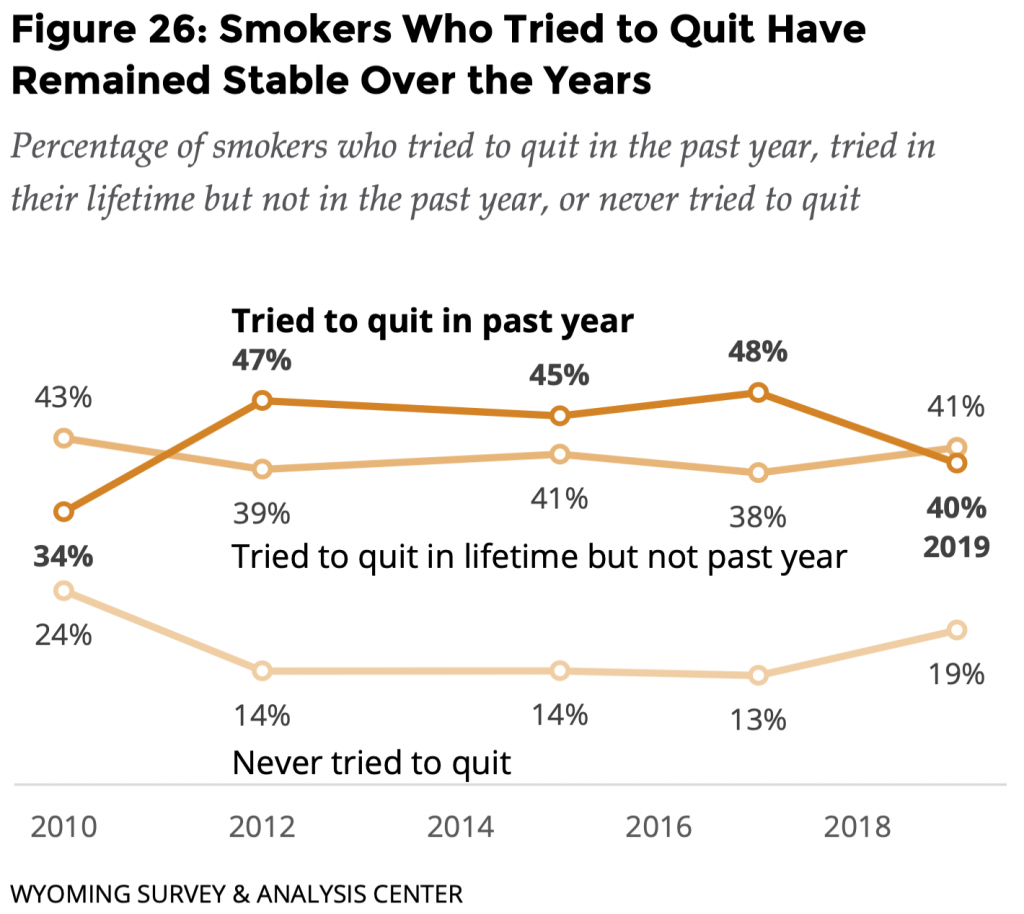

The percentage of smokers who have tried to quit has remained consistent over the years (Figure 26).

Awareness of Quitlines

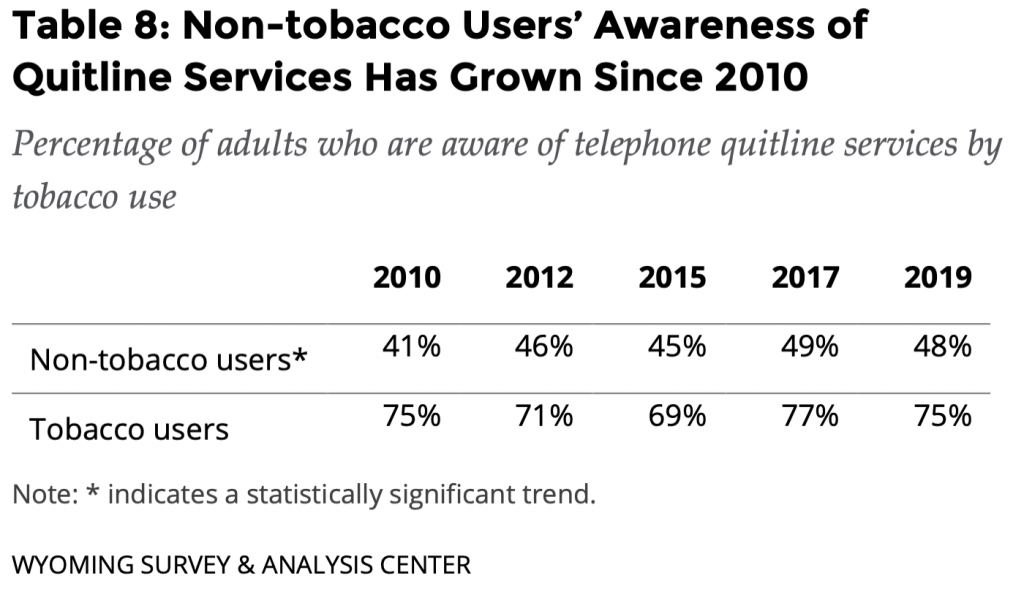

About half (48%) of non-tobacco users were aware of telephone quitline services. Non-tobacco users’ awareness has significantly grown over the years (Table 8).

Three-fourths (75%) of tobacco users were aware of telephone quitline services. Tobacco users’ awareness of quitlines has remained consistent over the years.

Smokers’ Use of Cessation Aids

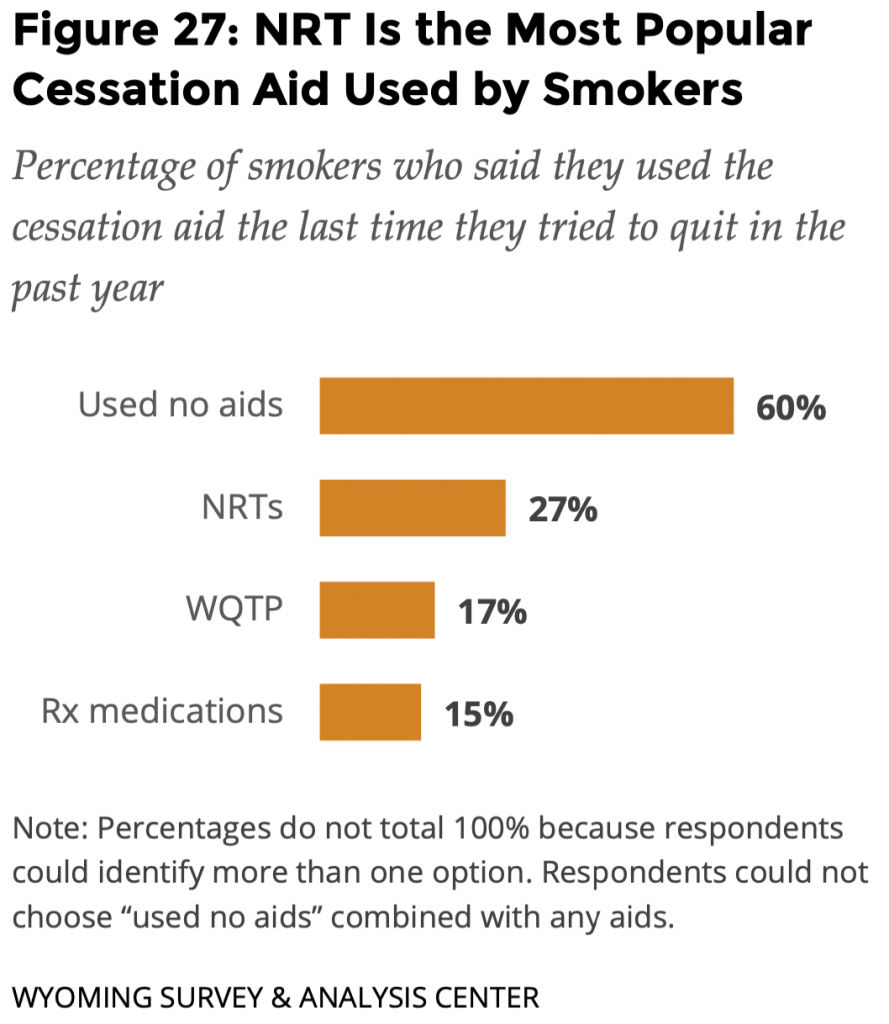

Three out of five (60%) smokers who tried to quit in the last year did not use any cessation aids. Nicotine replacement therapy (NRT) is the most popular cessation aid used by smokers trying to quit (Figure 27). This may include people buying them over-the-counter themselves or by getting them from the WQT program.

Three out of five (60%) smokers who tried to quit in the last year did not use any cessation aids. Nicotine replacement therapy (NRT) is the most popular cessation aid used by smokers trying to quit (Figure 27). This may include people buying them over-the-counter themselves or by getting them from the WQT program.

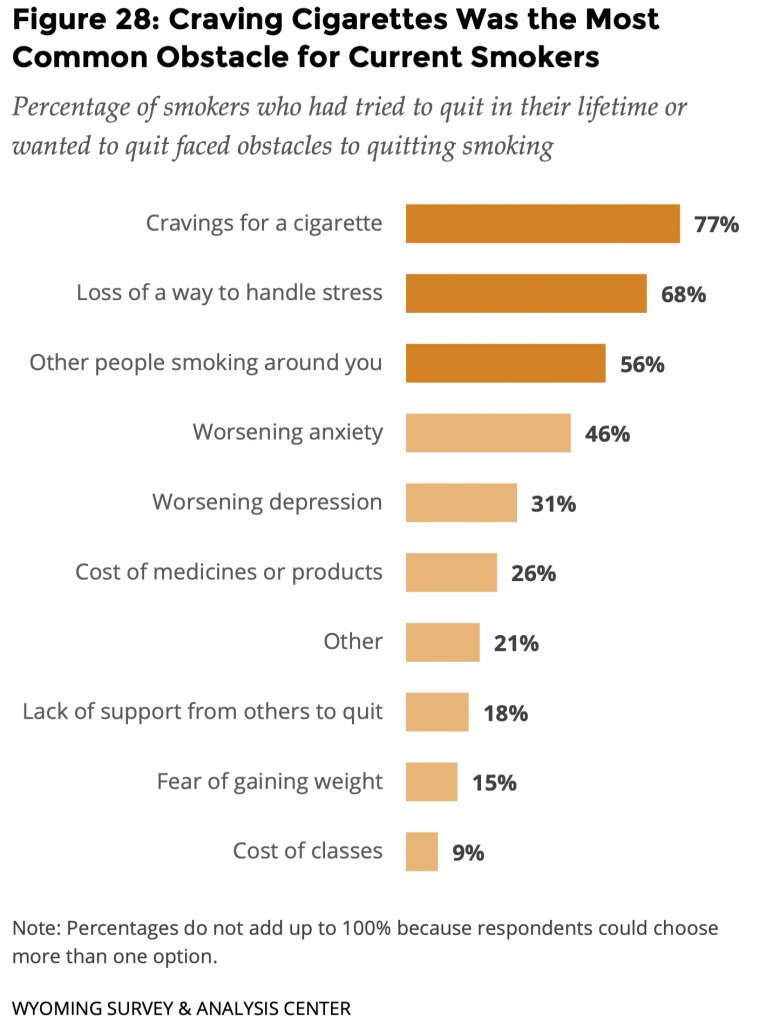

Smokers’ Obstacles to Quitting Smoking Cigarettes

Cravings for a cigarette was the most common obstacle for current smokers the last time they tried to quit (77%; Figure 28). Current smokers said other obstacles to quitting cigarettes included the loss of a way to handle stress (68%) and other people smoking around them (56%).

Cravings for a cigarette was the most common obstacle for current smokers the last time they tried to quit (77%; Figure 28). Current smokers said other obstacles to quitting cigarettes included the loss of a way to handle stress (68%) and other people smoking around them (56%).

The WQT program specifically targets the most common barriers to quitting smoking (https://www.quitwyo.org). In particular, the medications provided are designed to reduce cravings. Coaching can include strategies to deal with other barriers.

Many of these obstacles differ significantly for smokers experiencing behavioral health conditions. For details, see the Goal Area 4: Identifying and Eliminating Tobacco-Related Disparities section.

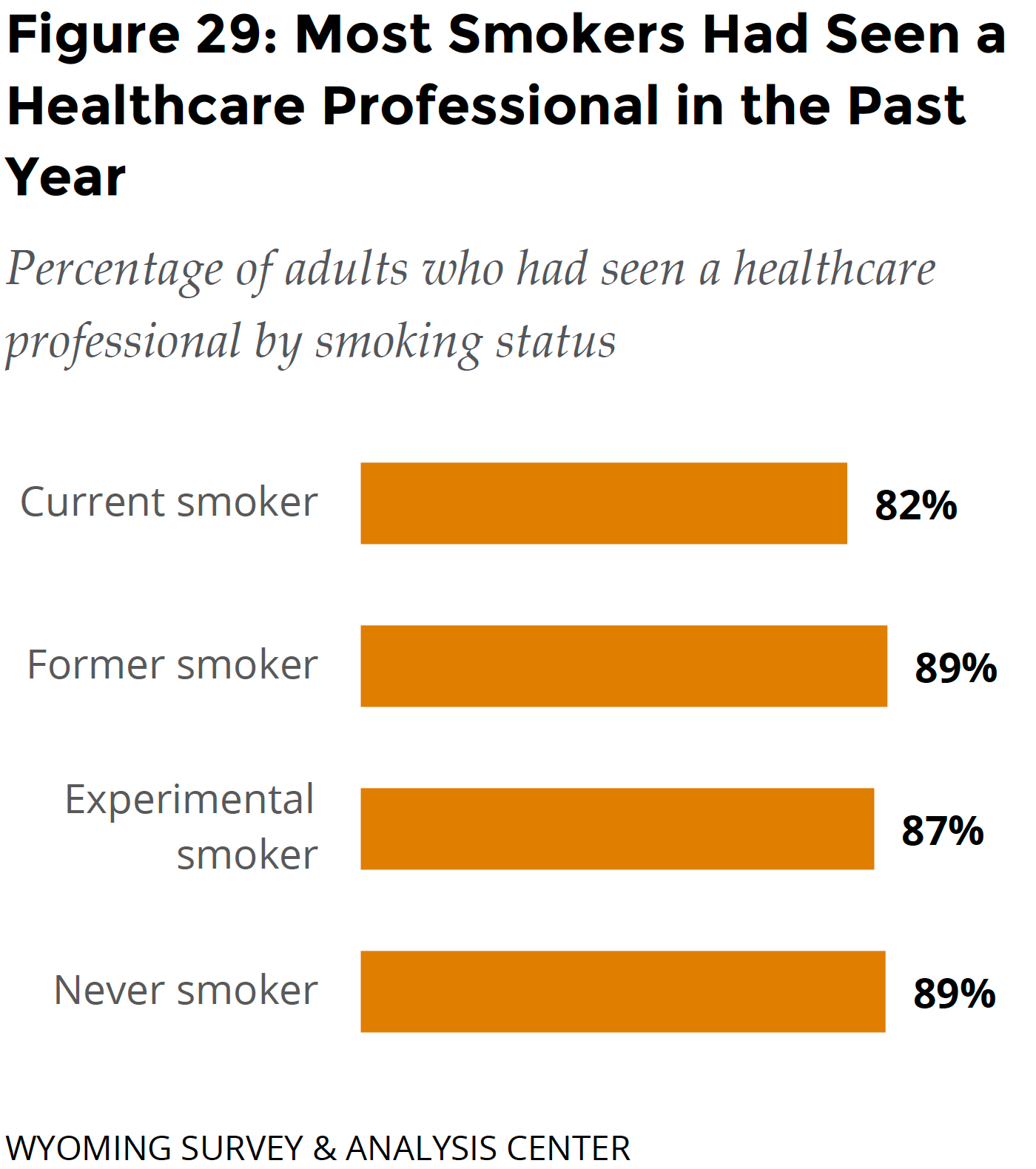

Smokers’ Visits with Healthcare Providers

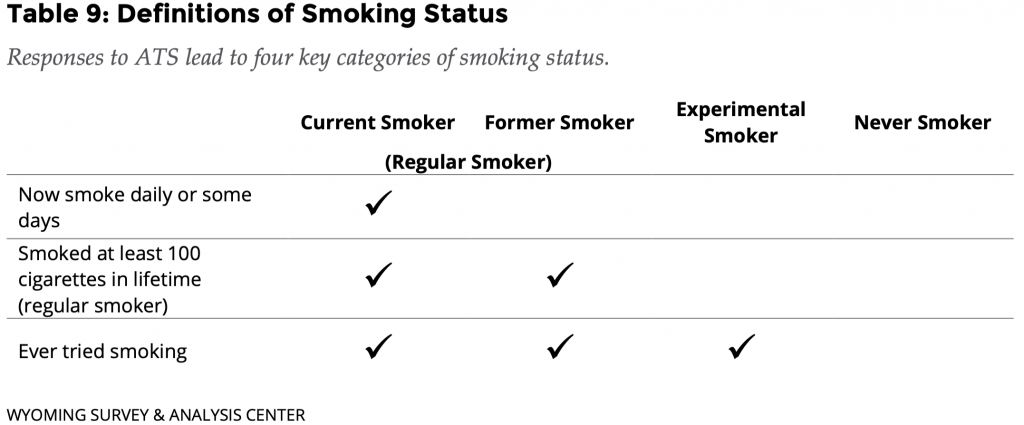

Most smokers had seen a healthcare professional in the past year (Figure 29). There was no significant relationship between seeing a healthcare professional and smoking status. For definitions of smoking status, see Table 9.

Most smokers had seen a healthcare professional in the past year (Figure 29). There was no significant relationship between seeing a healthcare professional and smoking status. For definitions of smoking status, see Table 9.

Tobacco Cessation and Tobacco Tax

Cigarette Tax Increase

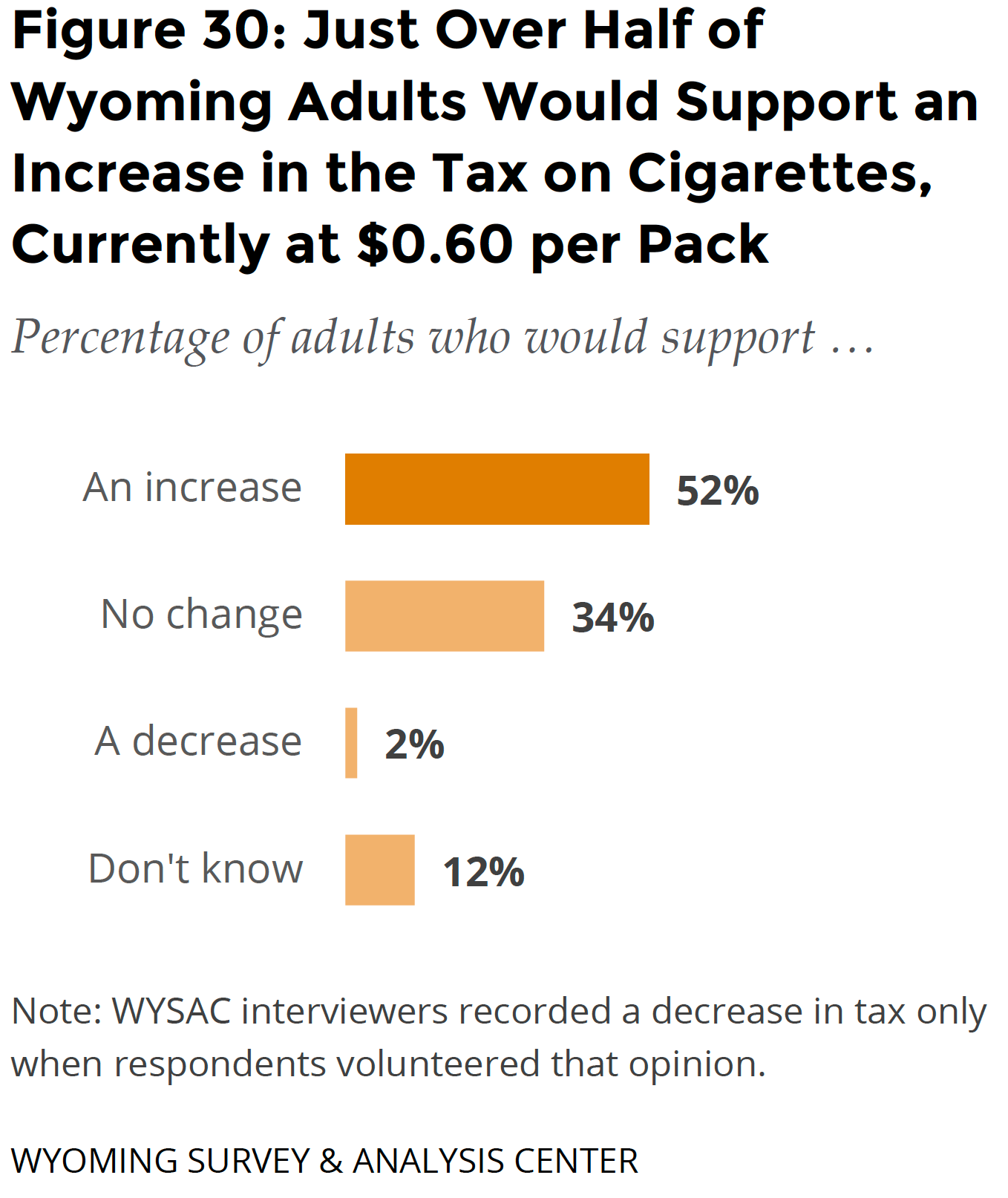

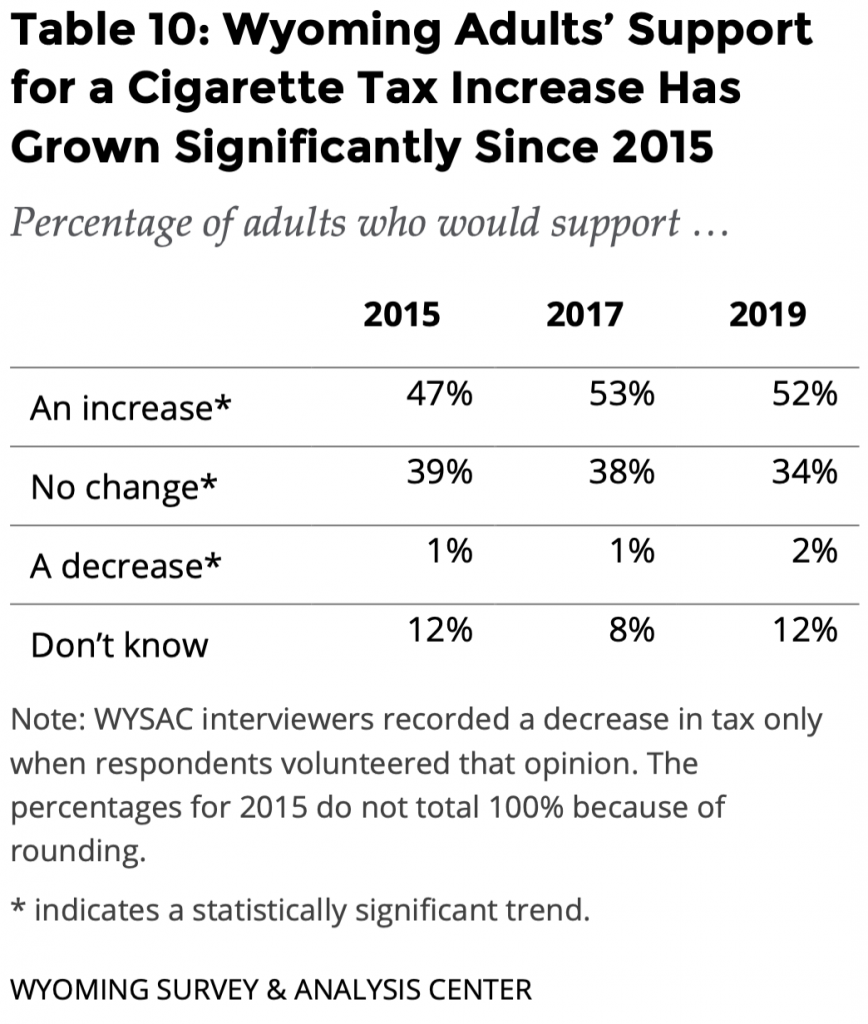

Increasing tobacco product prices is an effective way to increase tobacco cessation (CDC, 2015b). It also discourages the initiation of tobacco use (CDC, 2014b). In Wyoming, the state’s cigarette excise tax has remained at $0.60 per pack since 2003. Just over half (52%) of Wyoming adults would support an increase in the tax on cigarettes (Figure 30).

Increasing tobacco product prices is an effective way to increase tobacco cessation (CDC, 2015b). It also discourages the initiation of tobacco use (CDC, 2014b). In Wyoming, the state’s cigarette excise tax has remained at $0.60 per pack since 2003. Just over half (52%) of Wyoming adults would support an increase in the tax on cigarettes (Figure 30).

Wyoming adults’ support for a cigarette tax increase has grown significantly since 2015 (Table 10). The Wyoming House of Representatives, Senate, and governor would have to approve a change to the cigarette tax.

Appendix B: Wyoming 2019 ATS Frequency Tables includes data on the price smokers paid for a pack or carton of cigarettes and use of special promotions to buy cigarettes.

Smokeless Tobacco Tax Increase

Wyoming state legislation currently taxes smokeless tobacco (chewing tobacco, snuff, dip, or snus) at $0.60 per ounce. A minimum tax of $0.60 is required even if the amount sold is less than one ounce. Over half (54%) of Wyoming adults said they would support an increase in the smokeless tobacco tax. A little over one third (36%) said they would not support an increase. Some respondents (10%) were not sure if they would support this tax increase. These findings have not changed significantly since 2015.

Conclusions

The majority of smokers want to quit smoking cigarettes and have tried to quit at some point in their lives. When they try to quit or want to quit, smokers face obstacles such as cravings for a cigarette, loss of a way to handle stress, and other people smoking around them. The WQT program is designed to assist with these obstacles.

The majority of smokers want to quit smoking cigarettes and have tried to quit at some point in their lives. When they try to quit or want to quit, smokers face obstacles such as cravings for a cigarette, loss of a way to handle stress, and other people smoking around them. The WQT program is designed to assist with these obstacles.

Most tobacco users are aware of quitline services, yet most smokers did not use any cessation aids. This choice probably made it less likely they would quit. Media emphasizing how the WQT program addresses common barriers to quitting smoking may increase enrollment in the WQT program and use of program services such as free medications.

Being around other people who are smoking was the third most commonly reported barrier to quitting smoking. Smokefree indoor air policies and laws may help many smokers who are trying to quit. They would also protect people who chose not to smoke from exposure to the harmful chemicals in secondhand smoke (CDC, 2015b).

Just under half of non-tobacco users were aware of telephone quitline services. Media campaigns can reach non-tobacco users who may encourage their family members who use tobacco to contact the WQT program.

Since 2010, about three-fourths of tobacco users were aware of telephone quitline services. Market research may be able to identify ways to reach the remaining fourth.

Since 2010, about three-fourths of tobacco users were aware of telephone quitline services. Market research may be able to identify ways to reach the remaining fourth.

Most adults (including current smokers) had seen a healthcare provider in the past year. This is an opportunity for healthcare providers to connect current smokers to available cessation resources and address barriers to quitting. Greater collaboration with healthcare providers could result in more tobacco users becoming aware of, and receptive to, cessation services (CDC, 2015b).

Public support for increasing the cigarette excise tax in Wyoming has grown significantly since 2015. Still, the cigarette excise tax has remained at $0.60 per pack since 2003. Increasing tobacco product pricing through taxation, minimum price laws, and other means is an evidence-based strategy for promoting cessation (CDC, 2015b).