Commercial Tobacco and Nicotine Taxes

Preventing new cigarette smoking and decreasing the use of other commercial tobacco and nicotine products are key goals of the SUTPP and the CDC.

According to the CDC, increasing commercial tobacco product prices is an effective way to prevent youth from starting to smoke (CDC, 2014b). It also encourages adults to quit smoking (CDC, 2015).

Taxes are one way that federal and state governments can influence commercial tobacco prices. Nationally, every 10% increase in cigarette prices decreases cigarette use by 3–5%. Raising cigarette prices prevents youth and people with lower incomes from smoking and reduces the average number of cigarettes smoked (USDHHS, 2014).

In one study of adults aged 50 years and older, a $1 increase in the price of cigarettes was associated with a 6% higher quit rate (Stevens et al., 2017). Increasing cigarette taxes could encourage quitting among adults and could decrease the risk of smoking-related diseases.

Commercial Tobacco and Nicotine Tax Rates

Cigarettes

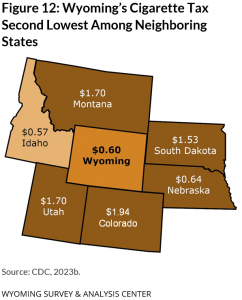

At the time of data collection, Wyoming’s cigarette excise tax was $0.60 per pack, the second lowest among neighboring states (Figure 12). Wyoming ranks 44th out of the 50 states and the District of Columbia on cigarette taxes and 51st out of the 58 states and territories (CDC, 2023b). Wyoming’s cigarette excise tax has not changed since 2003.

Smokeless Tobacco

At the time of data collection, Wyoming’s smokeless tobacco (chewing tobacco, dip, or snus) tax had a minimum tax of $0.60 per ounce, with an additional $0.60 per ounce for packaging larger than one ounce.

Electronic Nicotine Delivery Systems (ENDS)

Since July 2020 and through the time of data collection, Wyoming has had a default ENDS tax at the rate of 15% of the wholesale purchase price. If the tax is not paid by the wholesaler, consumers pay 7.5% of the retail purchase price (Wyo. Stat. § 39-18-104[g], 2021).

Support for Evidence-Based Policy

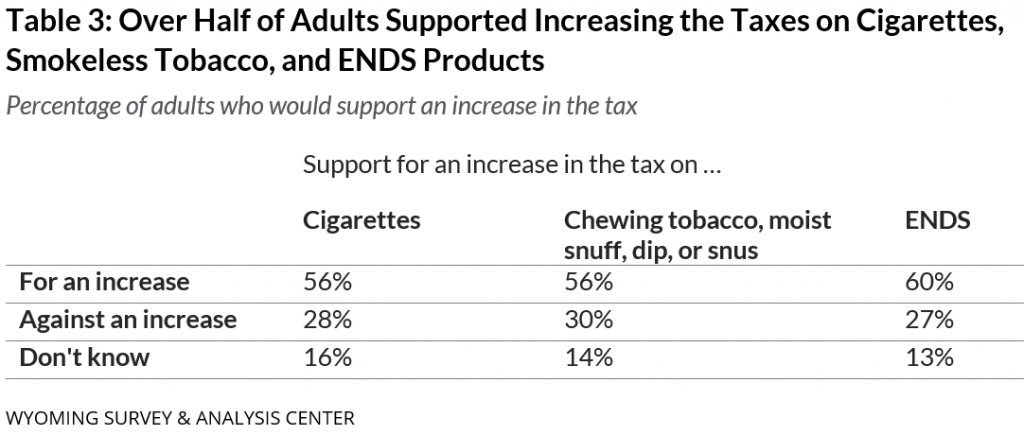

More than half of adults support tax increases for each major class of commercial tobacco and nicotine products: cigarettes (56%), smokeless tobacco (chewing tobacco, moist snuff, dip, or snus; 56%), and ENDS (60%; Table 3).

Costs of Smoking

Smoking is the leading preventable cause of illness and death in the United States. In 2018, the costs of smoking-related illness totaled more than $600 billion. These costs included more than $240 billion for direct medical care and more than $372 billion in lost productivity (CDC, 2022b).

- In 2019 (SEOW, 2024), commercial tobacco use costs in Wyoming totaled $1.5 billion. This total comes from four categories of costs:

- $814.1 million for intangible costs such as reduced quality of life because of sickness and disability

- $629.4 million for indirect costs such as premature death and reduced efficiency or lost time at work

- $62.2 million for direct healthcare costs

- $3.8 million for other direct costs such as fires

To provide additional context, the approximate size of Wyoming’s economy in 2019 was $38.6 billion as measured by the gross domestic product (GDP). Total costs for commercial tobacco use were about 4% the size of Wyoming’s economy. An alternative perspective is that smoking costs the Wyoming economy about $2,600 per person (regardless of smoking status) in 2019.

Conclusion

Wyoming’s cigarette excise tax has remained at $0.60 per pack since 2003. Over half of Wyoming adults support increasing taxes on commercial tobacco or nicotine.

Higher commercial tobacco taxes are an evidence-based way to keep youth from starting to smoke (CDC, 2014b). Increasing commercial tobacco product pricing through taxation, minimum price laws, or other means is an evidence-based strategy for encouraging people to quit using commercial tobacco products (CDC, 2015). Wyoming could further reduce negative outcomes from smoking by raising its commercial tobacco or nicotine taxes.