Reduce Smoking Initiation

Smokers Usually Start Young

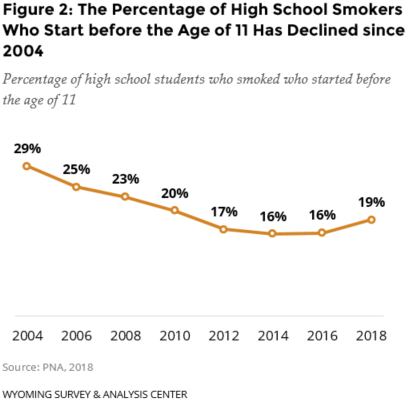

Smoking initiation is defined as the age at which a person first smokes one whole cigarette. According to the 2018 Prevention Needs Assessment (PNA), 19% of high school smokers started smoking before turning 11. This has declined by 34% since 2004 when it was 29% (Figure 2). WDH efforts, the efforts of the CDC, and the efforts of other public health organizations (e.g., the Campaign for Tobacco-Free Kids) probably contributed to this success in tobacco prevention.

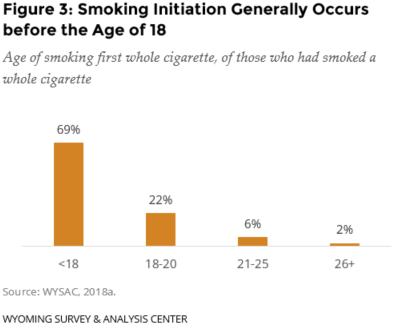

More than two thirds (69%) of Wyoming adults who had smoked a whole cigarette started smoking (smoked their first whole cigarette) before the age of 18; 91% started smoking before the age of 21. Few (8%) started smoking after the age of 20 (Figure 3; WYSAC, 2018a).

Preventing Youth Access

Part of stopping youth from starting to use tobacco is limiting access to tobacco products (CDC, 2014c). The Substance Abuse and Mental Health Services Administration (SAMHSA) requires states to complete annual, random, unannounced inspections of tobacco retailers, known as Synar inspections. SAMHSA requires the noncompliance rate for Synar inspections to be below 20%. Exceeding that rate may result in loss of federal funding for substance abuse prevention and treatment (SAMHSA, 2010). During Wyoming’s Synar inspections, trained 16- and 17-year-olds use a script to try to purchase cigarettes or smokeless tobacco from a sample of Wyoming tobacco retailers accessible to minors. Violations during Synar inspections do not result in actual sales, so citations are not issued.

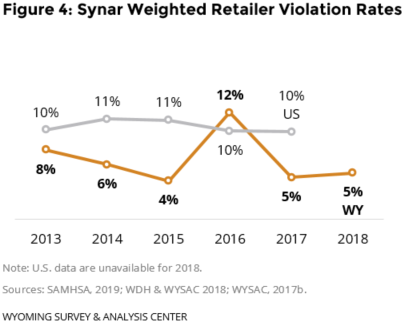

Wyoming’s Synar violation rates have usually been similar to the national violation rates (Figure 4). In 2016, however, Wyoming’s Synar noncompliance rate was unusually high because specific geographic areas had high violation rates. Since 2007, clerks failing to ask inspectors for identification has been the strongest predictor of retailer violations (WDH & WYSAC, 2018; WYSAC, 2017b).

Wyoming’s Synar violation rates have usually been similar to the national violation rates (Figure 4). In 2016, however, Wyoming’s Synar noncompliance rate was unusually high because specific geographic areas had high violation rates. Since 2007, clerks failing to ask inspectors for identification has been the strongest predictor of retailer violations (WDH & WYSAC, 2018; WYSAC, 2017b).

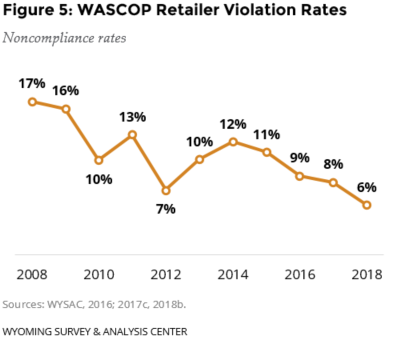

Each year, the Wyoming Association of Sheriffs and Chiefs of Police (WASCOP) conducts additional inspections of tobacco retailers. During WASCOP inspections, adolescent inspectors attempt to purchase cigarettes or smokeless tobacco. Unlike Synar inspections, these compliance checks allow law enforcement officers to issue warnings or citations to merchants who sell to minors (WYSAC, 2016; 2017c; 2018b). Violation rates treat repeated visits to outlets as unique inspections and are generally slightly higher for WASCOP inspections (Figure 5) than Synar inspections (Figure 4).

Wyoming retailers are generally compliant with laws limiting youth access to tobacco products (WDH & WYSAC, 2018; WYSAC, 2016; 2017b; 2017c; 2018b). A challenge for tobacco prevention remains because data show that underage youth get tobacco despite legal restrictions. Besides buying tobacco for themselves, sources include relatives, unrelated adults or minors, taking it, and other non-specified sources (PNA, 2018 [based on 2014 data as the most recent year the question was asked]; Youth Risk Behavioral Surveillance System [YRBSS], 2015).

Wyoming retailers are generally compliant with laws limiting youth access to tobacco products (WDH & WYSAC, 2018; WYSAC, 2016; 2017b; 2017c; 2018b). A challenge for tobacco prevention remains because data show that underage youth get tobacco despite legal restrictions. Besides buying tobacco for themselves, sources include relatives, unrelated adults or minors, taking it, and other non-specified sources (PNA, 2018 [based on 2014 data as the most recent year the question was asked]; Youth Risk Behavioral Surveillance System [YRBSS], 2015).

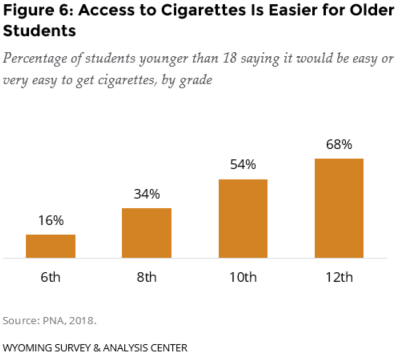

In 2018, 25% of Wyoming middle-school students and 57% of Wyoming high-school students under the age of 18 said it would be easy (either sort of easy or very easy) to get some cigarettes. Students in higher grades reported easier access to cigarettes (Figure 6; PNA, 2018). Synar compliance checks in Wyoming have shown that clerks are more likely to sell tobacco to older or older-looking minors (WDH & WYSAC, 2019; WYSAC, 2017b). Together, these findings suggest that it is easier for youth to illegally purchase or otherwise access cigarettes as they and fellow students approach the age of 18.

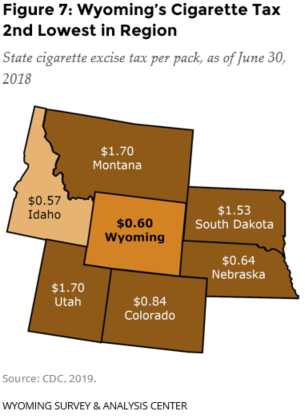

Increasing the price of tobacco products, usually by increasing taxes, is another strategy to keep youth from starting to use tobacco (CDC, 2014c; Chaloupka et al., 2012; Guide to Community Preventive Services, 2015). State tax rates vary from a low of $0.17 per pack in Missouri to a high of $4.35 per pack in New York and Connecticut (Figure 7). The average state tax rate on cigarettes is $1.79 (not including the federal tax or territories, but including the District of Columbia). Wyoming’s tax is the eighth lowest in the nation (CDC, 2019).

Increasing the price of tobacco products, usually by increasing taxes, is another strategy to keep youth from starting to use tobacco (CDC, 2014c; Chaloupka et al., 2012; Guide to Community Preventive Services, 2015). State tax rates vary from a low of $0.17 per pack in Missouri to a high of $4.35 per pack in New York and Connecticut (Figure 7). The average state tax rate on cigarettes is $1.79 (not including the federal tax or territories, but including the District of Columbia). Wyoming’s tax is the eighth lowest in the nation (CDC, 2019).

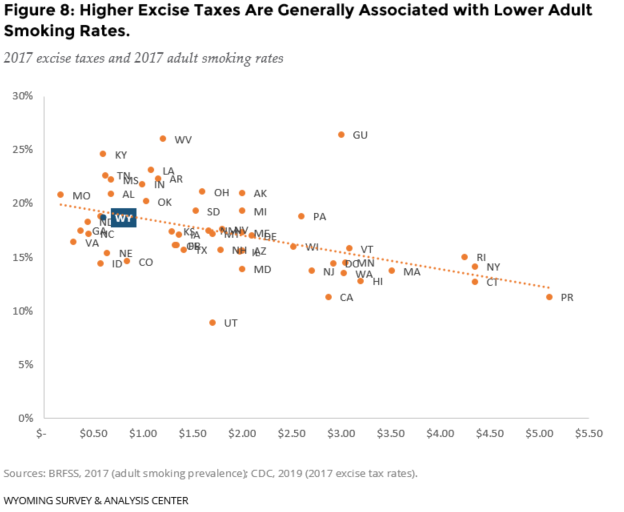

Consistent with CDC’s approach to prevention (CDC, 2014c; 2015b), states that have low cigarette smoking rates tend to have relatively high excise tax rates (Figure 8).

Consistent with CDC’s approach to prevention (CDC, 2014c; 2015b), states that have low cigarette smoking rates tend to have relatively high excise tax rates (Figure 8).

Like every state that has implemented a significant cigarette tax increase (Farrelly et al., 2003), Wyoming experienced a decrease in cigarette consumption and an increase in tax revenue when it last raised its cigarette excise tax on July 1, 2003. Cigarette tax revenue increased from $6.6 million (in 2014 dollars; equivalent to $5.1 million in 2003, but adjusted for inflation to allow direct comparison to the 2014 amount) in the fiscal year before the tax increase took effect to $19.1 million in fiscal year 2014 (Wyoming Department of Revenue [WYDOR], ca. 2014). In 2014, WYSAC estimated that a $1.00 price increase would decrease the amount of cigarettes adults in Wyoming smoke by 6% while generating $30.1 million (adjusted for inflation from $29.2 million as estimated in 2014) of additional revenue during the first year (WYSAC, 2014).